Classical

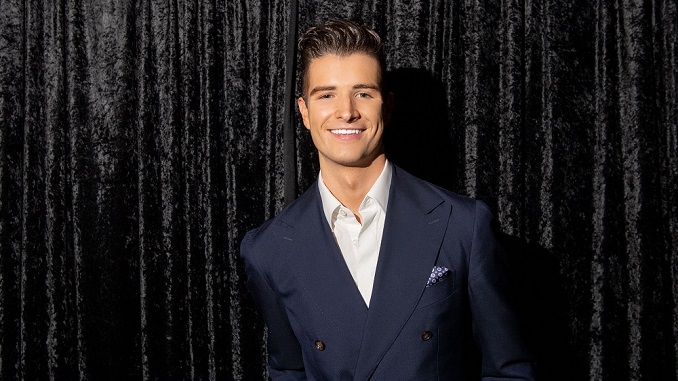

Kissin / Goerne (Concert Review): A Poet’s Love

North American audiences can consider themselves lucky that Evgeny Kissin, one of the finest concert pianists of his day, has deigned to go on tour with baritone Matthias Goerne for a programme of Schumann and [...]